AWS SageMaker Finance: 7 Powerful Ways to Transform Financial Services

In a world where milliseconds determine market wins, financial institutions are turning to machine learning not as a luxury—but as a lifeline. AWS SageMaker Finance emerges as the silent architect behind smarter trading, fraud detection, and risk modeling, blending scientific precision with real-world impact.

AWS SageMaker Finance: Revolutionizing the Financial Industry

Financial services have long relied on statistical models and human intuition to make decisions. However, with the exponential growth of data and the increasing complexity of global markets, traditional methods are no longer sufficient. AWS SageMaker Finance has emerged as a transformative force, enabling banks, hedge funds, insurance companies, and fintech startups to build, train, and deploy machine learning (ML) models at scale—without requiring deep expertise in data science infrastructure.

Amazon Web Services (AWS) introduced SageMaker as a fully managed service to simplify the ML workflow. When applied to finance, SageMaker becomes a powerhouse for predictive analytics, algorithmic trading, credit scoring, and regulatory compliance. By abstracting away the complexities of setting up servers, managing GPUs, and tuning hyperparameters, AWS SageMaker Finance allows financial engineers and quantitative analysts to focus on what matters: extracting value from data.

According to a 2023 report by McKinsey, financial institutions that adopted cloud-based ML platforms like AWS SageMaker saw a 30–50% reduction in model development time and a 40% improvement in prediction accuracy for fraud detection systems. This isn’t just about automation—it’s about redefining what’s possible in finance.

What Is AWS SageMaker?

AWS SageMaker is a fully integrated development environment for machine learning. It provides every tool needed to go from data preparation to model deployment, all within a secure, scalable cloud infrastructure. For financial institutions, this means faster time-to-market for ML-driven products and services.

SageMaker includes built-in algorithms optimized for performance, automatic model tuning (hyperparameter optimization), one-click deployment to production endpoints, and real-time monitoring. It supports popular frameworks like TensorFlow, PyTorch, and MXNet, making it flexible for teams with diverse technical backgrounds.

Crucially, SageMaker operates on AWS’s global infrastructure, ensuring high availability, low latency, and compliance with financial regulations such as GDPR, SOC 2, and PCI-DSS. This regulatory alignment is essential for institutions handling sensitive customer data.

Why Finance Needs SageMaker

The financial sector generates vast amounts of structured and unstructured data daily—from transaction logs and market feeds to customer service transcripts and news sentiment. Extracting actionable insights from this data requires more than traditional business intelligence tools; it demands adaptive, self-learning systems.

Machine learning models can detect subtle patterns invisible to humans, such as micro-trends in stock prices or behavioral anomalies indicating fraud. However, building these models in-house used to require assembling large teams of data scientists, DevOps engineers, and ML specialists—an expensive and time-consuming endeavor.

AWS SageMaker Finance democratizes access to advanced ML capabilities. Smaller fintech firms can now compete with Wall Street giants by leveraging the same cloud-powered tools. As stated by AWS CEO Adam Selipsky:

“SageMaker removes the heavy lifting from ML so that domain experts—like financial analysts—can innovate faster.”

- Reduces dependency on niche ML engineering talent

- Accelerates experimentation and A/B testing of trading strategies

- Enables real-time inference for time-sensitive decisions

Core Use Cases of AWS SageMaker Finance

The application of AWS SageMaker in finance spans multiple domains, each addressing critical business challenges. From detecting fraudulent transactions to optimizing investment portfolios, SageMaker provides the infrastructure and tools to turn data into decisions.

These use cases are not theoretical—they are actively deployed by leading institutions. JPMorgan Chase, for example, uses SageMaker to power its COiN platform, which analyzes legal documents and extracts key financial clauses in seconds, a task that previously took thousands of human hours.

The scalability and flexibility of AWS SageMaker Finance make it ideal for both real-time and batch processing scenarios. Whether it’s scoring millions of loan applications overnight or predicting market movements during live trading hours, SageMaker handles the load seamlessly.

Fraud Detection and Anomaly Identification

Fraud costs the global financial industry over $40 billion annually, according to the Association of Certified Fraud Examiners (ACFE). Traditional rule-based systems often fail to catch sophisticated, evolving fraud schemes. Machine learning, particularly unsupervised and semi-supervised learning, offers a more dynamic solution.

AWS SageMaker Finance enables institutions to build anomaly detection models using algorithms like Random Cut Forest (RCF) and DeepAR. These models learn normal transaction behavior and flag deviations in real time. For example, if a customer typically spends $100 weekly on groceries but suddenly makes a $10,000 purchase in a foreign country, the model can trigger an alert or block the transaction automatically.

SageMaker’s built-in RCF algorithm is specifically designed for streaming data, making it ideal for credit card processors and digital wallets. It can process millions of transactions per second with sub-second latency, ensuring minimal disruption to legitimate users.

One European bank reduced false positives by 60% after migrating its fraud detection system to AWS SageMaker, while improving detection rates by 25%. The bank used SageMaker Processing Jobs to clean and enrich transaction data, then trained a custom ensemble model using SageMaker Training Jobs before deploying it via SageMaker Endpoints.

Credit Risk Assessment and Loan Underwriting

Traditional credit scoring relies heavily on historical credit data, often excluding underbanked populations. AWS SageMaker Finance allows lenders to incorporate alternative data sources—such as utility payments, rental history, and even social media behavior—into risk models, enabling fairer and more accurate assessments.

Using SageMaker’s XGBoost algorithm, financial institutions can build classification models that predict the likelihood of default with higher precision. These models can be retrained daily using fresh data, adapting to changing economic conditions such as inflation spikes or unemployment trends.

A fintech startup in Southeast Asia leveraged AWS SageMaker Finance to launch a microloan platform for gig economy workers. By ingesting mobile phone usage patterns and GPS mobility data, the startup built a risk model that approved 35% more applicants than traditional banks, while maintaining a default rate below 5%.

SageMaker Clarify can also be used to audit models for bias, ensuring compliance with fair lending laws like the Equal Credit Opportunity Act (ECOA). This transparency is crucial as regulators increasingly demand explainability in algorithmic decision-making.

Algorithmic Trading and Market Prediction

High-frequency trading (HFT) firms compete on microseconds. AWS SageMaker Finance provides the computational muscle and low-latency infrastructure needed to develop and deploy predictive trading models at scale.

Quantitative analysts use SageMaker Notebooks to prototype models using historical price data, technical indicators, and alternative data like satellite imagery or social media sentiment. Once validated, these models are trained using SageMaker’s distributed training capabilities and deployed as real-time inference endpoints.

For instance, a hedge fund might use SageMaker to train a Long Short-Term Memory (LSTM) network to predict stock price movements based on news sentiment scraped from financial websites. The model can be updated hourly using SageMaker Pipelines, ensuring it adapts to breaking news and market shifts.

AWS also integrates with Amazon Kinesis and Amazon Managed Streaming for Apache Kafka (MSK) to stream market data into SageMaker in real time. This enables event-driven trading strategies where models react instantly to new information.

- Supports backtesting of trading strategies using historical data

- Enables reinforcement learning for adaptive trading agents

- Integrates with AWS Lambda for serverless execution of trading signals

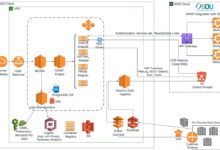

Building a Machine Learning Pipeline with AWS SageMaker Finance

Creating a successful ML application in finance isn’t just about training a model—it’s about building a robust, end-to-end pipeline that ensures data quality, model accuracy, and operational reliability. AWS SageMaker Finance provides a comprehensive suite of tools to orchestrate this pipeline seamlessly.

The typical ML workflow in finance includes data ingestion, preprocessing, model training, evaluation, deployment, monitoring, and retraining. SageMaker unifies all these stages within a single platform, reducing integration complexity and improving reproducibility.

Each component of the pipeline is fully programmable via SDKs and APIs, allowing teams to automate workflows and integrate with existing financial systems like core banking platforms or trading engines.

Data Preparation and Feature Engineering

Data is the foundation of any ML system. In finance, data comes from disparate sources: transaction databases, market data feeds, customer relationship management (CRM) systems, and external APIs. AWS SageMaker Finance simplifies data integration through SageMaker Data Wrangler, a visual tool that allows users to import, clean, transform, and visualize data without writing code.

Data Wrangler supports over 100 built-in transformations, including normalization, outlier detection, and categorical encoding. It also integrates with AWS Glue and Amazon Athena for querying data stored in Amazon S3, enabling seamless access to petabyte-scale datasets.

Feature engineering—creating meaningful input variables for models—is particularly critical in finance. For example, deriving a “debt-to-income ratio” from raw financial statements or calculating moving averages from stock prices can significantly improve model performance. SageMaker Feature Store provides a centralized repository for storing, sharing, and versioning features across teams, ensuring consistency and reducing duplication.

A major U.S. bank used SageMaker Feature Store to standardize 1,200+ financial features across its retail banking, wealth management, and commercial lending divisions. This reduced feature drift and improved model interoperability, cutting development time by 40%.

Model Training and Hyperparameter Optimization

Training an ML model involves feeding data into an algorithm and adjusting its internal parameters to minimize prediction error. In finance, where accuracy directly impacts profitability, even small improvements in model performance can yield millions in gains.

AWS SageMaker Finance offers both built-in algorithms (like Linear Learner, XGBoost, and K-Means) and support for custom models written in Python or R. Training jobs can be scaled horizontally across multiple GPU instances, reducing training time from days to hours.

SageMaker Automatic Model Tuning (also known as hyperparameter tuning) uses Bayesian optimization to find the best combination of hyperparameters—such as learning rate, tree depth, or batch size—without manual trial and error. This is especially valuable in finance, where models must be retrained frequently to adapt to market changes.

For example, a credit card issuer used SageMaker’s hyperparameter tuning to optimize a fraud detection model, achieving a 12% increase in AUC (Area Under the Curve) compared to manually tuned models. The process ran 100 training jobs in parallel, automatically selecting the best-performing configuration.

Model Deployment and Real-Time Inference

Once a model is trained, it must be deployed to a production environment where it can make predictions on new data. AWS SageMaker Finance simplifies deployment with one-click hosting on scalable endpoints.

These endpoints support real-time inference (synchronous requests) and batch transformations (asynchronous processing of large datasets). For time-sensitive applications like fraud detection or algorithmic trading, real-time inference with sub-100ms latency is critical.

SageMaker also supports multi-model endpoints (MMEs), allowing dozens of models to share the same computing resources. This is ideal for financial institutions that need to serve multiple risk models—e.g., one for credit cards, another for personal loans—without incurring high infrastructure costs.

Additionally, SageMaker supports canary deployments and A/B testing, enabling gradual rollout of new models. If a new fraud detection model underperforms, traffic can be automatically routed back to the previous version, minimizing risk.

Security, Compliance, and Governance in AWS SageMaker Finance

Financial institutions operate under strict regulatory frameworks. Any ML system must ensure data privacy, model transparency, and auditability. AWS SageMaker Finance is designed with these requirements in mind, offering robust security features and compliance certifications.

SageMaker runs within a Virtual Private Cloud (VPC), isolating ML workloads from the public internet. Data at rest is encrypted using AWS Key Management Service (KMS), and data in transit is protected with TLS 1.2+. IAM roles and policies ensure least-privilege access, so only authorized users and services can interact with SageMaker resources.

For compliance, AWS provides attestations for SOC 1, SOC 2, PCI-DSS, HIPAA, and GDPR. This means institutions can confidently use SageMaker for processing payment data, health-related financial products, or EU customer information.

Data Privacy and Encryption

In finance, data breaches can lead to massive fines and reputational damage. AWS SageMaker Finance ensures end-to-end data protection through multiple layers of encryption and access control.

All data stored in Amazon S3 for SageMaker is encrypted by default. When data is processed in SageMaker Notebooks or Training Jobs, it can be further protected using VPC endpoints and security groups. For highly sensitive workloads, AWS offers SageMaker Studio with AWS PrivateLink, which keeps traffic within the AWS network.

Additionally, SageMaker supports customer-managed encryption keys (CMKs), allowing institutions to maintain full control over key rotation and revocation. This is particularly important for banks subject to central bank regulations.

Model Explainability and Auditability

Regulators increasingly demand that financial decisions be explainable. A customer denied a loan cannot be given a simple “the algorithm said no”—they must receive a clear rationale.

AWS SageMaker Finance addresses this with SageMaker Clarify, a tool that detects bias in datasets and models and generates explainability reports. It uses SHAP (SHapley Additive exPlanations) values to show how each feature contributed to a prediction.

For example, if a loan application is rejected, Clarify can show that the decision was primarily driven by a high debt-to-income ratio, not by demographic factors. This transparency supports compliance with anti-discrimination laws and builds customer trust.

SageMaker Model Monitor continuously tracks model performance in production, alerting teams to data drift or concept drift. If a model’s accuracy drops below a threshold, it can trigger automatic retraining, ensuring consistent decision quality.

Cost Optimization and Scalability in AWS SageMaker Finance

One of the biggest advantages of AWS SageMaker Finance is its pay-as-you-go pricing model. Unlike on-premises data centers, where institutions must over-provision hardware for peak loads, SageMaker scales elastically based on demand.

This is particularly valuable in finance, where workloads can be highly variable—e.g., end-of-quarter risk reporting or flash trading events. With SageMaker, resources are provisioned only when needed, reducing idle capacity and lowering costs.

According to AWS, customers typically achieve 50–70% cost savings compared to maintaining in-house ML infrastructure. These savings come from reduced capital expenditure, lower operational overhead, and improved resource utilization.

Spot Instances and Cost-Efficient Training

Machine learning training jobs are often computationally intensive and can run for hours or days. AWS SageMaker Finance allows the use of EC2 Spot Instances for training, which can reduce costs by up to 90% compared to On-Demand Instances.

Spot Instances leverage unused AWS capacity, making them ideal for fault-tolerant workloads. SageMaker automatically handles instance interruptions by checkpointing model state and resuming training on a new instance.

A European asset manager used Spot Instances to train a portfolio optimization model, cutting training costs from $1,200 to $150 per run. By combining Spot Instances with SageMaker’s managed spot training feature, they achieved reliable performance at a fraction of the price.

Auto-Scaling and Serverless Inference

For inference workloads, SageMaker offers auto-scaling based on traffic patterns. Endpoints can scale from zero to thousands of instances in minutes, ensuring high availability during peak demand.

Serverless Inference, introduced in 2022, takes this further by automatically provisioning and managing compute resources. This is ideal for intermittent workloads, such as fraud detection during business hours or batch scoring of loan applications overnight.

With Serverless Inference, institutions pay only for the milliseconds their model is running, with no need to manage instance types or capacity. This granular billing model can lead to significant savings, especially for startups or departments with limited budgets.

Real-World Success Stories: AWS SageMaker Finance in Action

Theoretical benefits are compelling, but real-world implementations prove the value of AWS SageMaker Finance. Across the globe, financial institutions are leveraging SageMaker to drive innovation, reduce risk, and improve customer experiences.

These case studies highlight not just technical success, but also business impact—increased revenue, reduced losses, and faster time-to-market. They serve as blueprints for other organizations considering cloud-based ML adoption.

JPMorgan Chase: Automating Legal Document Analysis

JPMorgan Chase’s Contract Intelligence (COiN) platform uses AWS SageMaker Finance to analyze commercial loan agreements. Previously, lawyers spent 360,000 hours annually reviewing documents to extract key terms like collateral and covenants.

With SageMaker, COiN now processes thousands of documents in seconds, extracting over 150 data points with 90% accuracy. The system uses natural language processing (NLP) models trained on historical contracts, continuously improving through feedback loops.

This automation has freed up legal teams to focus on higher-value tasks, while reducing processing time from days to minutes. The project has since expanded to other document types, including merger agreements and regulatory filings.

Capital One: Real-Time Fraud Detection

Capital One processes over 100 million transactions daily. To combat fraud, they built a real-time detection system using AWS SageMaker Finance and Amazon Kinesis.

Transaction data streams into Kinesis, where it’s preprocessed and fed into a SageMaker endpoint running a deep learning model. The model evaluates each transaction in under 50 milliseconds, assigning a risk score. High-risk transactions are flagged for review or blocked instantly.

Since deployment, Capital One has reduced fraudulent losses by 20% while improving customer experience by minimizing false positives. The system re-trains weekly using SageMaker Pipelines, adapting to new fraud patterns.

Ant Group: Credit Scoring for the Unbanked

Ant Group, the financial arm of Alibaba, uses AWS SageMaker Finance to power its Sesame Credit system. By analyzing mobile payment behavior, online shopping patterns, and social connections, the platform provides credit scores for millions of unbanked individuals in China.

The ML models are trained on petabytes of data using SageMaker’s distributed training. Feature engineering is automated using SageMaker Feature Store, ensuring consistency across regions and products.

This system has enabled microloans to small businesses and individuals who lack traditional credit histories, driving financial inclusion while maintaining low default rates. The model’s explainability features also help users understand how to improve their scores.

Future Trends: The Evolution of AWS SageMaker Finance

The intersection of machine learning and finance is evolving rapidly. As new technologies emerge—such as generative AI, quantum computing, and decentralized finance (DeFi)—AWS SageMaker Finance is poised to play a central role in shaping the future of financial services.

Amazon continues to invest heavily in SageMaker, adding new features every quarter. Recent launches include SageMaker Canvas for no-code ML, SageMaker JumpStart for pre-trained models, and integration with Amazon Bedrock for generative AI applications.

These advancements will further lower the barrier to entry, enabling non-technical users—such as financial advisors or compliance officers—to leverage ML in their daily workflows.

Generative AI and Financial Content Creation

Generative AI models, like those based on large language models (LLMs), are transforming how financial institutions create content. AWS SageMaker Finance, combined with Amazon Bedrock, allows banks to generate personalized investment reports, customer communications, and regulatory filings at scale.

For example, a wealth management firm could use a fine-tuned LLM to draft quarterly portfolio reviews for thousands of clients, customized with performance insights and market commentary. The model can be trained on historical reports and client preferences using SageMaker Training Jobs.

These systems must be carefully governed to avoid hallucinations or biased language. SageMaker Clarify and Model Monitor help ensure content quality and regulatory compliance.

Federated Learning for Privacy-Preserving Analytics

Federated learning allows multiple institutions to collaboratively train a model without sharing raw data. This is particularly valuable in finance, where data privacy is paramount.

AWS SageMaker Finance is exploring support for federated learning through partnerships with research institutions. For example, a group of banks could jointly train a fraud detection model using their combined transaction data, while keeping each dataset isolated within their own VPC.

This approach enhances model accuracy without violating privacy laws, opening new possibilities for industry-wide collaboration.

Integration with Blockchain and DeFi

Decentralized finance (DeFi) platforms are growing rapidly, but they lack the risk management tools of traditional finance. AWS SageMaker Finance can bridge this gap by providing ML-powered credit scoring, liquidity forecasting, and smart contract auditing for blockchain applications.

By analyzing on-chain transaction data, SageMaker models can assess the risk of lending protocols or predict price volatility in crypto markets. This could enable safer, more efficient DeFi platforms that attract institutional investors.

Amazon has already partnered with blockchain firms like Chainalysis to enhance crypto compliance, and future integrations with SageMaker could unlock powerful new use cases.

What is AWS SageMaker Finance?

AWS SageMaker Finance refers to the application of Amazon SageMaker—a fully managed machine learning service—within the financial services industry. It enables institutions to build, train, and deploy ML models for use cases like fraud detection, credit scoring, and algorithmic trading, leveraging AWS’s scalable cloud infrastructure.

How does AWS SageMaker improve fraud detection in banking?

AWS SageMaker improves fraud detection by enabling real-time anomaly detection using machine learning models like Random Cut Forest. It processes streaming transaction data, identifies suspicious patterns, and reduces false positives through continuous model retraining. Integration with Amazon Kinesis allows low-latency processing, crucial for blocking fraudulent transactions instantly.

Can small fintech companies afford AWS SageMaker Finance?

Yes, small fintech companies can afford AWS SageMaker Finance due to its pay-as-you-go pricing model. They can start with minimal investment using free tiers and scale as needed. Features like Spot Instances and Serverless Inference further reduce costs, making advanced ML accessible even to startups with limited budgets.

Is AWS SageMaker compliant with financial regulations?

Yes, AWS SageMaker is compliant with major financial regulations including GDPR, SOC 2, PCI-DSS, and HIPAA. It offers encryption, audit logging, and access controls to ensure data security and regulatory compliance. Financial institutions can deploy SageMaker within a VPC and use AWS PrivateLink for enhanced isolation.

How does SageMaker handle model explainability for loan denials?

SageMaker handles model explainability through SageMaker Clarify, which generates SHAP values to show how each input feature influenced a prediction. For loan denials, it can provide clear reasons—such as high debt-to-income ratio—helping institutions comply with fair lending laws and improve customer transparency.

The integration of AWS SageMaker Finance into the financial ecosystem represents a paradigm shift—from reactive, rule-based systems to proactive, learning-driven intelligence. By democratizing access to machine learning, AWS empowers institutions of all sizes to innovate faster, manage risk better, and serve customers more effectively. As the financial landscape continues to evolve, SageMaker stands as a foundational tool for building the next generation of intelligent financial services.

Further Reading: